Market Review December 2025

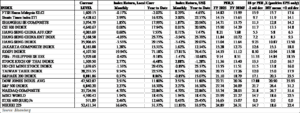

Risk assets trading volatility heightened in November on fluctuating probability of Fed decision to reduce interest rate in the upcoming meeting in December. The World Index gained 0.18% in November. The MSCI Far East Ex. Japan index corrected, declining 3.68%, on profit taking in North Asia markets in particular Korea and Taiwan markets. ASEAN equities performed better with a return of +0.92%, led by Indonesia (+4.22%) and Vietnamese (+3.13%). The performance of regional currencies was mixed against the local currency. The best performing currencies were Malaysia Ringgit (+1.38%) and Thai Baht (+0.69%), while the weaker ones were Taiwanese NT (-2.08%) and Korean Won (-2.60%).

Risk assets trading volatility heightened in November on fluctuating probability of Fed decision to reduce interest rate in the upcoming meeting in December. The World Index gained 0.18% in November. The MSCI Far East Ex. Japan index corrected, declining 3.68%, on profit taking in North Asia markets in particular Korea and Taiwan markets. ASEAN equities performed better with a return of +0.92%, led by Indonesia (+4.22%) and Vietnamese (+3.13%). The performance of regional currencies was mixed against the local currency. The best performing currencies were Malaysia Ringgit (+1.38%) and Thai Baht (+0.69%), while the weaker ones were Taiwanese NT (-2.08%) and Korean Won (-2.60%).

Performance of US indices diverged with technology sector underperforming. The market remained resilient on the back of the Federal Reserve’s dovish stance and corporate earnings remaining strong from previous quarter. Year-over-year earnings growth reached 13%, driven by over 7% revenue growth and 6% margin expansion. Technology-related earnings were particularly impressive. The 2025 consensus earnings-per-share growth expectation for the Magnificent Seven increased to over 22%, which is now significantly higher than the 15% estimate from seven months ago. For the month, Dow Jones Industrial Average (DJIA) and S&P 500 Index gained 0.32% and 0.13% respectively. Nasdaq Composite corrected 1.51% on profit taking.

The Stoxx Europe 600 Index added 0.79% from prior month, driven by potential US Fed rate cut and resilient European corporate earnings. The euro zone’s annual inflation rate edged higher to 2.2% in November 2025 marking a modest increase from October’s 2.1% reading and slightly exceeding economist expectations. This is above the European Central Bank’s 2% target, reinforcing market expectations that the central bank will maintain its current monetary policy stance through the remainder of the year.

Hong Kong and H shares indices witnessed continued profit taking in November. Hang Seng Index and Hang Seng China Enterprises Index declined 0.18% and 0.42% respectively. Chinese A shares also corrected, declining 2.46%. Chinese economy continued to face headwinds. The latest manufacturing purchasing manufacturing index (PMI) stood at 49 and remained in contraction stage. It dropped 0.8 from the previous month. China’s exports unexpectedly contracted in October. Exports fell for the first time in eight months, dropping 1.1% from a year earlier. Shipments to all nations except the US rose 3.1%, not enough to compensate for the more than 25% decline to America.

South Korea’s KOSPI Index retraced, declining 4.40% in November on profit taking. South Korea’s industrial output posted its steepest decline in nearly six years in October, driven by a strong base effect from the robust readings in the previous month. The industrial output declined 2.5% to 112.9 in October from a month earlier. It is the largest decline since a 2.9% fall in February 2020.

Taiwan’s TWSE Index declined 2.15% on global risk off on technology sector. Taiwan export orders reached US$69.37bn in October, down 1.2% MoM, but up 25.1% Year-on-year, below consensus (median) of 28% Year-on-year growth, and last month’s unusually high 30.5% Year-on-year growth. Research Centre for Taiwan Economic Development said the consumer confidence index edged up 0.69 points to 64.65, marking improvements across most sub-indices. Consumers remained cautious amid tariff concerns but economic performance has been stronger than expected.

Singapore’s STI continued to move higher, gaining 2.15%. Singapore’s economy grew 4.2% Year-on-year in Q3 2025, supported mainly by manufacturing, wholesale trade and finance, with construction slowing but retail and accommodation improving, leading the government to raise full-year GDP growth forecast to around 4%. Singapore’s NODX jumped 22.2% Year-on-year in October, the fastest since 2021, driven by strong electronic exports (PCs, ICs, disk media) and non-electronics (gold, pharma, machinery), with sharp increases to Thailand, Hong Kong, Taiwan, South Korea and Malaysia, while exports to the US fell due to new tariffs.

Malaysia’s KLCI declined 0.29% on strong currency gain. However, mounting pressure on fiscal constraint arising from Sabah’s claim for a bigger share of oil revenue from Sabah affected domestic investors’ sentiment. On the economic front, the World Bank upped its projection for Malaysia’s economic growth in 2025 to 4.1% versus its earlier forecast of 3.9%.

Thailand’s SET Index declined 4.03%. Thailand’s economy contracted 0.6% Quarter-on-quarter in 3Q25, deeper than expected and marking its first decline in nearly three years due to weak domestic demand, external headwinds, and limited impact from new government measures. Private consumption slowed, government spending fell sharply, while fixed investment rebounded after four quarters of contraction. Net trade supported growth as exports rose modestly and imports shrank.

Jakarta Composite Index continued to strengthen with a 4.22% gain. Indonesia’s consumer confidence rose to 121.2 in October 2025, up from 115.0 in September. Retail sales growth accelerated to 4.3% Year-on-year in October from a revised 3.7% in September and 3.5% in August, driven mainly by higher spending on F&B and household equipment. On a monthly basis, retail sales rose 0.6% MoM, rebounding from a 2.4%.

The Philippines PSE Index recovered on bargain hunting after few months of correction, gaining 1.56%. The political risk continued to hinder government ability to boost economic activities. There has already been a sharp slowdown in infrastructure spending, a key factor in the economic slowdown to a four-year low of 4% growth in the third quarter of 2025.

Vietnam’s VN-Index gained 3.13%. The country’s inflation remained under control. Consumer prices in the first 10 months of 2025 rose 3.27% from a year earlier, with most monthly increases staying below 0.2%. Vietnam’s trade data shows that the US tariff has had limited impact thus far. Vietnam’s exports rose 18% Year-on-year and 10% Quarter-on-quarter in Q3, with September/ October growth at 17%/25% Year-on-year even after the front-loading period. PMI, new orders, and new export orders have recovered since July.

Market optimism over the election of Donald Trump as the new US President on expectations that his policies would be positive for the US had sparked a recalibration of macro variables and asset allocation decision. However, the US Administration’s subsequent tariff announcements and the inconsistent and frequent policy changes made in their wake had led to heightened market gyrations and volatility. Following the broad sell off after the announcement of across-the-board reciprocal tariffs on “Liberation Day”, the markets have recovered much of their losses as the shifting tariffs landscape seemed to have reached some stability. With the finalization of tariff rates with majority of US’ trading partners, trade matters are heading into tailwind, at least for now. As for the US tariff for China, the US and China teams held talks in Kuala Lumpur followed by a meeting between President Trump and President Xi in Busan. Both sides described the meetings as constructive. The US did not proceed with the threatened 100% tariff, and agreed to cut tariffs on China goods from 57% to 47%, while the tariffs on fentanyl related chemicals were reduced from 20% to 10%. The US also agreed to suspend port fees on Chinese shipments. China, on its part, agreed to suspend export restrictions on rare earth elements, and committed to resume purchase of US soybeans. It remains a matter of conjecture as to whether the tariff dusts have really settled for good.

During his Presidential election campaign, Donald Trump had also pitched to bring about a quick end to the Russia-Ukraine war should he be elected. Since his inauguration as US President, Trump has made moves, seeking to bring about a cessation of the conflict in Ukraine. The latest being a face-to-face Summit between him and President Putin held in Anchorage on August 15. An end to the Ukraine conflict would be positive for the equity markets. However, a peaceful resolution of the conflict does not appear to be any nearer. It remains to be seen if Trump and his Administration will succeed in orchestrating a cessation of the conflict in Ukraine. If this does come about, it would change the geo-political situation in Europe and elsewhere. Meanwhile, in the Middle East, Israel and Hamas agreed to a fragile ceaseful at the behest of Trump. That is very much welcome, but the geopolitical headwinds remain.

The shift of market focus to dovish monetary stance will likely be supportive of risk assets in near term. The Fed reduced rates by 25 basis points in November. However, there is much uncertainty as to whether there will be a further reduction in December. The market is still divided on impact of higher tariffs on macro variables such as inflation and economic activities. US corporate earnings especially in the technology sector continue to be key pillar to hold up risk assets. High valuation is further supported by strong capital expenditure drive for AI. However, questions are starting to emerge as to whether the humongous expenditures in AI will generate the anticipated returns.

We are watchful of geo-political developments as well as policy directions in the major economies, in particular US and in China. The market is still watchful of developments in Trump’s tariffs for the key trade partners. The market is also attentive to other US policy pronouncements that would have major fiscal, financial and economic implications. Investors, by and large, appear to be comfortable with Trump’s “Big Beautiful Bill” that has been signed into law, notwithstanding that it will substantially increase US federal deficit and government debt. The US government went into a prolonged shutdown following failure by the US to pass a Bill to raise US’ debt ceiling. However, US investors were not unduly concerned about this development, and the US market has taken it in its stride.

In Asia, the focus is on the pace of China’s economic recovery which has been weaker than expected. The tariff issues with the US and continuing efforts to broaden restrictions on sales of tech equipment and services to Chinese entities can only exacerbate the economic situation in China. The Chinese property sector continues to face challenges, and any sign of stabilization and growth will have positive catalyst for China’s economy and risk assets. The Chinese government continues to bring forth various measures to help the economy. The Chinese government remains constructive on policies to spur economic activities to achieve economic growth target. The various measures have boosted market sentiments. However, the longer- term effectiveness on China’s economy continues to be closely watched. It may take time for the initiative to bear fruits. The focus will be on addressing the challenges in the property market, lifting consumer sentiments and consumption, and countering the effects of the new US tariffs.

On external trade, countries with high export dependency for growth in the Asia region including ASEAN will face significant challenges arising from the US tariff policies, even at the agreed rates that are significantly below the levels announced by the US during the “Liberation Day”. The disruption in supply chain realignment may result in temporary mismatch in corporate earnings delivery against market expectation during the initial stage of tariff implementation. This can result in further trading volatility for risk assets. Longer-term, higher tariffs may result in corporate margin erosion and slower earnings growth outlook. Consumers in the importing country may have to pay higher prices, and this translates to higher inflation rate.

While interest rates have started to be eased, there remains headwind for risk assets, including the impact of the still high interest rate on business and economic activities, uncertainties in US policies post the US Presidential election, the still rising and historically high market valuations in the US, the continuing geo-political tension in Europe, Middle East and in East Asia, and the still slower than expected economic growth in China. However, in the investment space we are in, we believe there is room for cautious optimism. After years of prolonged sell down, and despite the upticks in recent months, China equities are under-owned and their favourable valuation offer potential upside, particularly following the recent rounds of significant policy change initiatives from China. Also, the prospect of further softening of the US dollar could see increasing funds flow out of US assets which could be beneficial for emerging markets including China and ASEAN.

We continue to apply our strategy of focusing on identifying fundamentally healthy companies with low valuations, low leverage, high growth, robust management and a strong track record, and adherence to our investment philosophy of “Never Fully Invest at All Times” which has served us well over the years.

We thank you once again for your continued faith in us, and hope to remain good stewards in our endeavor to protect and grow your capital.